Karachi’s stock market saw a downturn on Wednesday as investors cashed in on profits amidst concerns about upcoming budget measures. The KSE 100 index closed below 75,000, reflecting cautious sentiment.

Analysts, including Ashan Mehanti of Arif Habib Corporation, attributed the market’s decline to widespread selling pressure fueled by concerns over potential tax hikes in the forthcoming federal budget for 2024-25. With the government under pressure to meet IMF directives for securing a new bailout package, apprehensions regarding harsh taxation policies intensified.

Beyond budgetary anxieties, factors such as political uncertainty, sluggish economic growth, and mounting circular debt in the power sector also contributed to the bearish sentiment at PSX. Sectors such as E&P, banking, and fertilizers experienced notable declines, with key players like Oil and Gas Development Company and Bank Al-Habib Ltd among the major losers.

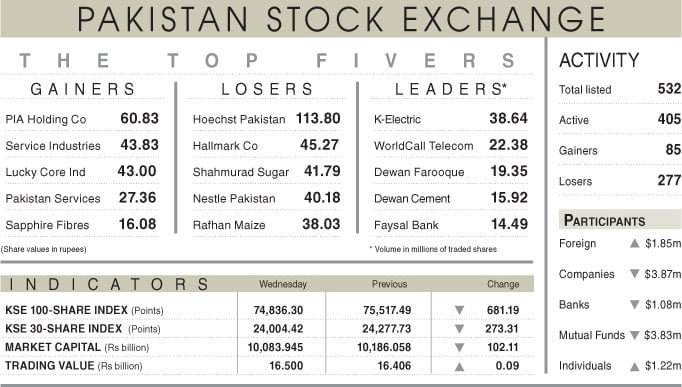

However, amidst the downturn, certain stocks managed to attract buying interest, providing a glimmer of hope amid the overall market decline. Service Industries Ltd, Lucky Core Industry, and Faysal Bank Ltd emerged as notable gainers, offsetting some of the losses incurred by the index.

While the benchmark index fluctuated between intraday highs and lows, ultimately settling at 74,836.30 points with a loss of 1.90%, foreign investors maintained their confidence in the market, remaining net buyers with shares worth $1.85 million. Their steadfast participation amidst market uncertainties underscores resilience and long-term confidence in Karachi’s stock market.