\The federal government unveiled the budget for the fiscal year ending June 2025 on Wednesday, with a goal of achieving 3.6% economic growth to secure a new bailout deal from the International Monetary Fund (IMF).

Key Takeaways

• Govt sets challenging tax revenue target of Rs13tr, around 40pc jump from outgoing year

• GDP growth target set at 3.5pc, inflation at 12pc

• Rs5.545tr collection targeted through income tax earnings; GST collection expected to be Rs4.9tr

• Petroleum levy upped from Rs60 to Rs80/litre

• 25pc rise proposed in salaries for govt employees in grades 1-16, 20pc in grades 17-22; pensions up 15pc

• Power subsidy to AJK increased to Rs108bn after unrest

• Aurangzeb stresses structural reforms to escape low-growth cycle

Here are some key points from the 2024-25 budget:

Economic Goals:

- Aims for 3.6% economic growth in 2024-25.

- Expects a fiscal deficit of 6.9% of GDP for 2024-25.

Expenditure:

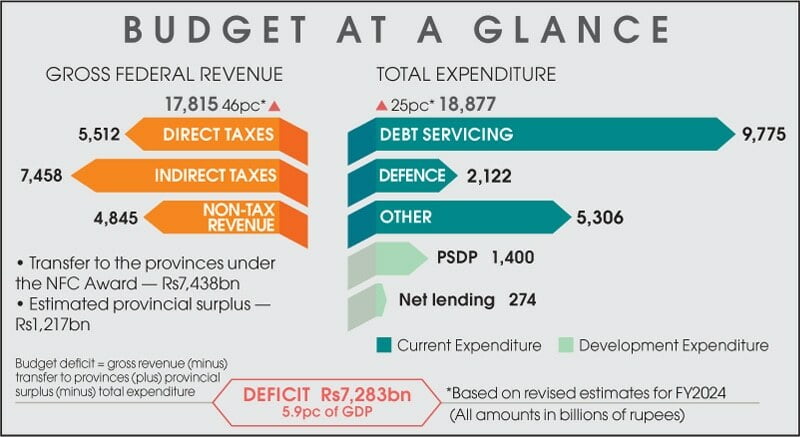

- Anticipates total spending of 18.9 trillion Pakistani rupees ($67.84 billion) in 2024-25.

- Foresees debt servicing of 9.8 trillion rupees in 2024-25.

- Plans for defense expenditure of 2.1 trillion rupees in 2024-25.

- Expects pension payments to reach 1 trillion rupees in 2024-25.

- Projects total subsidies at 1.4 trillion rupees in 2024-25.

- Plans for a 27% increase in cash handouts to 600 billion rupees under income support in 2024-25.

Revenue:

- Aims for total tax revenue of 13 trillion rupees for 2024-25.

- Targets total non-tax revenue of 3.5 trillion rupees in 2024-25.

- Aims to generate 30 billion rupees from privatization in 2024-25.

Salary, pension, social support

Irony is that the government does not appear to reduce its expenditures for next year, as it expanded salary, pension, and development budgets. The finance minister promised reforms in the pension scheme and rightsizing of government jobs going forward.

He announced a 25pc increase in the salaries for government employees in grades 1-16, 20pc in grades 17-22 and 15pc for pensioners, as government employees built pressure outside the Parliament House ahead of the budget session.

According to Dawn News The budget speech that was delayed for almost two hours owing to political challenges posed by the PML-N’s coalition partner PPP resulted in the deletion of a major tax reform.

This pertained to withdrawal of tax exemptions to formerly tribal areas now merged with Khyber Pakhtunkhwa and instead the introduction of income tax exemption to the people of provincial and federal tribal regions for one year. Both these measures were removed from the speech as influential industrial and commercial operators secured protection.