In a stunning corporate upheaval, Unilever (ULVR.L) has abruptly fired CEO Hein Schumacher, replacing him with finance chief Fernando Fernandez to accelerate the company’s turnaround. The unexpected move, backed by billionaire activist investor Nelson Peltz, left even Schumacher blindsided, though insiders insist there was “nothing untoward” about his removal.

Unilever’s board, fully aligned on the decision, sought to speed up the execution of its strategy and drive quicker value creation. Schumacher, who took the helm in July 2023, had introduced a series of cost-cutting measures, including plans to separate the ice cream division and reduce thousands of jobs. However, despite the initial praise for his leadership, the board ultimately decided a change was necessary.

In an email to colleagues, Schumacher defended his track record and expressed regret over his early departure. His sudden exit rattled investors, sending Unilever shares down as much as 3.4% on Tuesday. The stock had previously gained over 9% since his appointment.

Unilever, like many consumer goods companies, has struggled with supply chain disruptions, soaring commodity prices, and shifts in consumer behavior. Margins have been squeezed as shoppers turn to cheaper alternatives, pressuring the company to rethink its growth strategy.

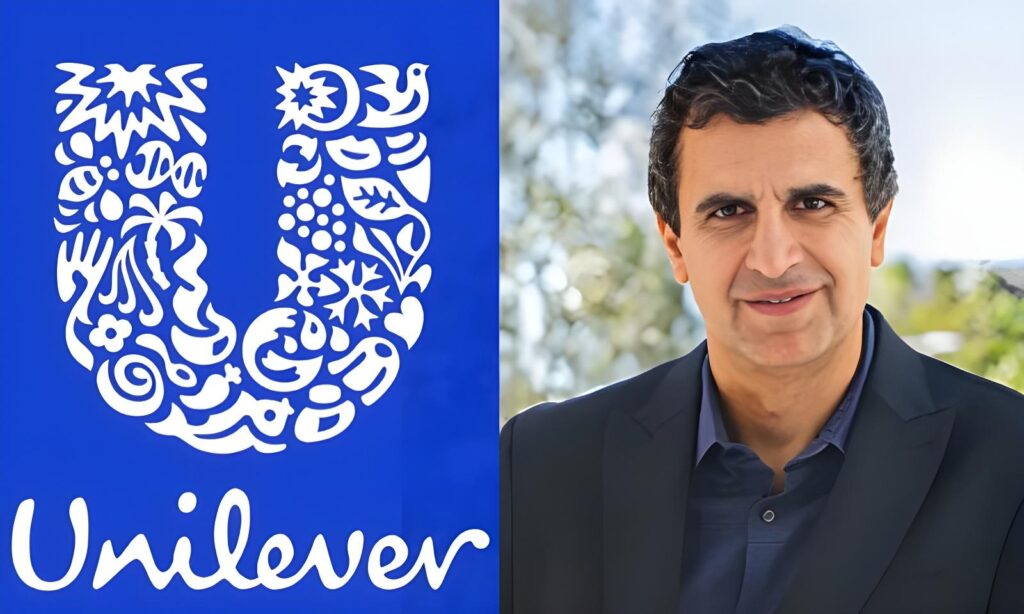

The decision to appoint Fernandez, a 36-year Unilever veteran, followed a board meeting on Monday, where members concluded he was the best choice to execute the company’s vision. Fernandez, 58, previously held key leadership roles, including CEO of Unilever Brazil and President of the Beauty & Wellbeing division. Analysts and investors were caught off guard but acknowledged Fernandez’s deep understanding of the business.

Chairman Ian Meakins praised Fernandez’s “decisive and results-oriented approach” and emphasized that the board remains committed to accelerating Unilever’s growth. RBC Capital analyst James Edwardes Jones called the leadership change “gobsmacking,” while Barclays analyst Warren Ackerman noted that Fernandez was “best placed to accelerate the value unlock.”

As Schumacher prepares to exit in May, Unilever assured investors that its 2025 outlook and medium-term forecasts remain unchanged. Meanwhile, Srinivas Phatak, currently deputy CFO and group controller, will step in as acting CFO while the company searches for a permanent replacement.

With a veteran insider now at the helm, Unilever faces mounting pressure to prove that this high-stakes shake-up will deliver the rapid growth its board demands.

With Schumacher’s departure and Fernandez stepping in, Unilever now stands at a critical crossroads. Investors will be watching closely to see if this leadership shake-up delivers the rapid transformation the board envisions. As the company navigates market challenges and reshapes its strategy, all eyes are on Fernandez to prove that Unilever’s bold gamble will pay off.