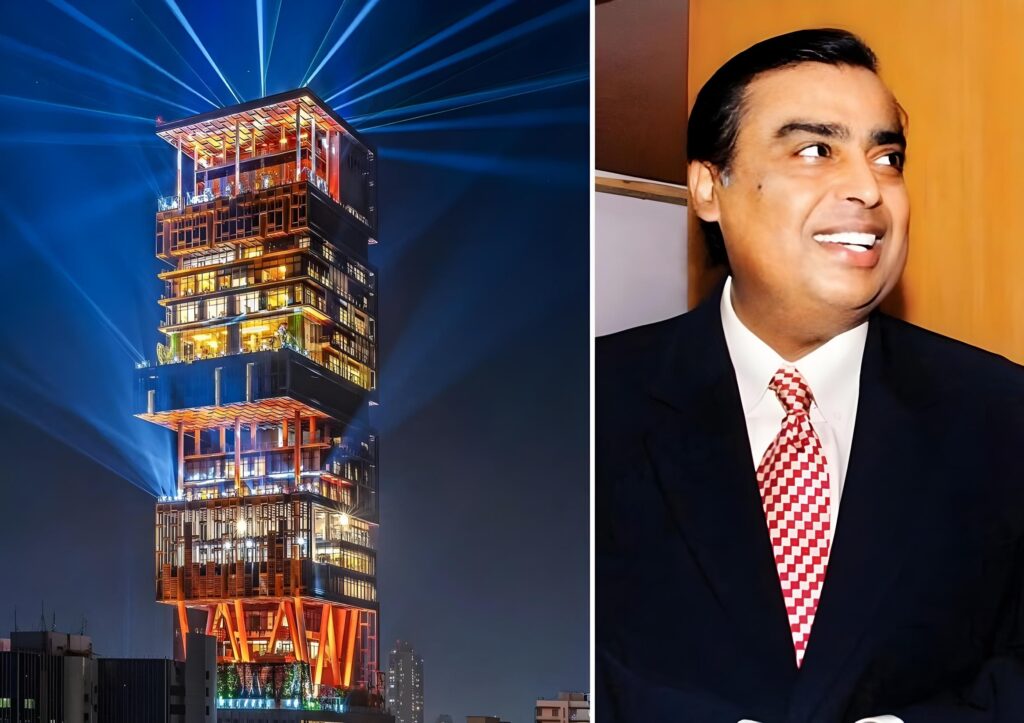

A turbulent week for Mukesh Ambani as Reliance Industries saw a staggering ₹67,526 crore erased from its market value in just five days. Despite the setback, Ambani remains Asia’s richest man, but investor anxiety is mounting amid broader market turbulence.

Why Reliance Shares Are Falling

The stock plunge aligns with a broader market downturn, affecting major blue-chip stocks. Key factors behind the decline include:

Global Economic Pressures: Concerns over U.S. Federal Reserve policies and foreign fund outflows have triggered volatility.

Sectoral Challenges: Volatility in oil prices and mounting telecom sector challenges have dampened investor confidence.

Broad Market Downturn: India’s stock indices, Sensex and Nifty, have faced eight consecutive sessions of losses, weighing down multiple sectors.

Reliance Tops Market Losses

Reliance led last week’s market slump, accounting for the largest portion of the ₹2,03,952.65 crore wiped off the top ten most valued companies. Other major losers included TCS, HDFC Bank, Infosys, and SBI. However, Bharti Airtel and ICICI Bank managed to defy the trend and posted gains.

Can Reliance Bounce Back?

While short-term volatility persists, analysts believe Reliance’s bet on renewables and Jio’s growth could steer its recovery. The company’s expansion in digital services and retail remains a key driver for future revenue.