The government is also considering comprehensive GST restructuring and other fiscal reforms with input from the IMF.

The government is mulling The government is mulling about introducing a carbon tax on petroleum and similar products. This move is being discussed to align with the International Monetary Fund’s (IMF) suggestion of implementing a comprehensive general sales tax (GST). This would help in documenting and digitizing the economy, according to sources.

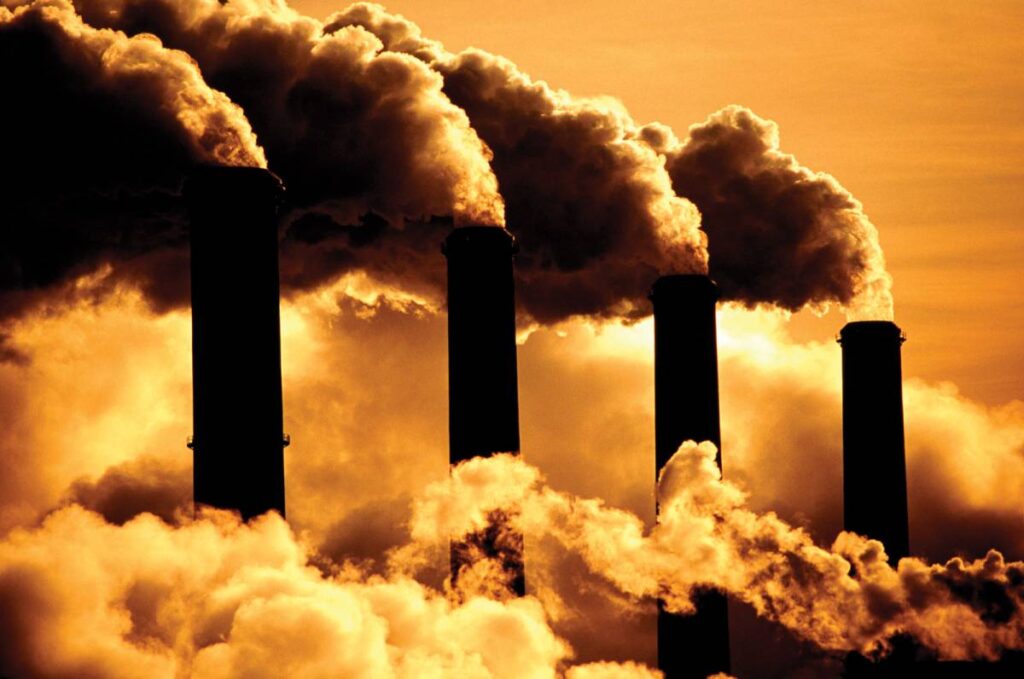

The carbon tax could not only generate revenue but also attract international financial support for initiatives like green bonds and cheaper loans from multilateral institutions. Additionally, it could aid in addressing climate change concerns by promoting environment-friendly practices and reducing greenhouse gas emissions.

The IMF has recommended reinstating a standard GST on petroleum products, alongside the existing petroleum levy, to streamline taxation across the economy. However, there are discussions about either reintroducing the carbon tax or increasing the petroleum levy threshold to enhance revenue collection, as the proceeds from these taxes remain with the federal government.

Furthermore, there are plans to strengthen social welfare initiatives such as the Benazir Income Support Programme (BISP) and adjust monthly stipends to counter the effects of inflation. The focus will also be on expanding the tax base through digitization and documentation efforts, with penalties for non-compliance.

To increase revenue, there are considerations for raising withholding tax on bank transactions for non-filers. Additionally, the government aims to implement measures to encourage retailers to register under specific schemes voluntarily.

The upcoming budget is expected to include measures for fiscal adjustment through revenue generation, expenditure rationalization, and privatization. Efforts will be made to broaden the tax base by implementing a more comprehensive VAT system and diversifying revenue sources.

Despite challenges such as political unrest and geopolitical tensions, the government plans to continue its reform agenda, including energy sector reforms, monetary policy tightening, and strengthening state-owned enterprises (SOEs).